Ban on Insurance for Penalties

The prohibition of insurance and indemnities for WHS penalties was recommended in the Marie Boland Review of the Model WHS Laws published in February 2019, and also the Senate Inquiry into industrial deaths published in October 2018.

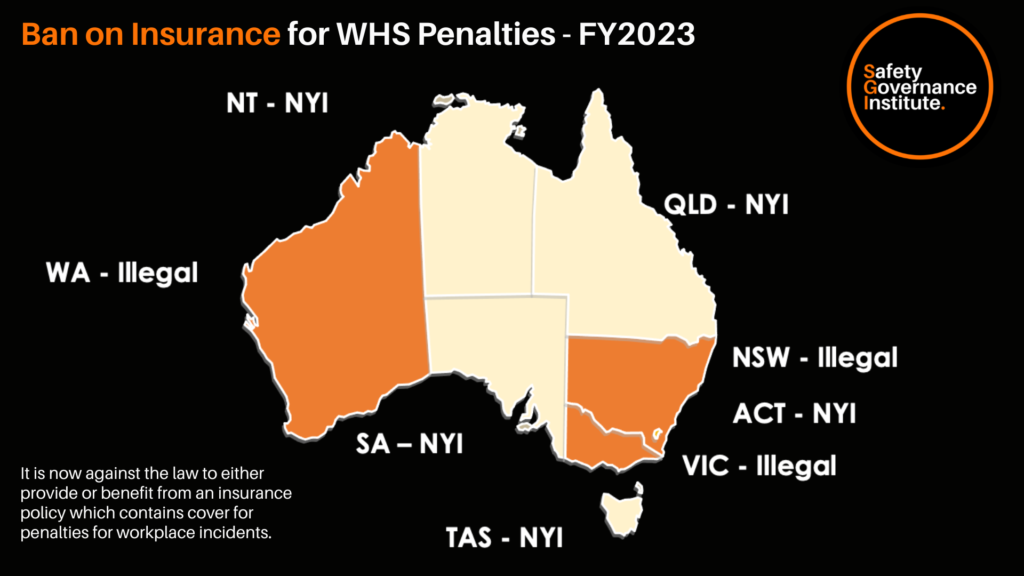

NSW was the first jurisdiction to implement the change, and has included the prohibition in its WHS Act. The prohibition came into effect in June 2020 and applies to WHS penalties for incidents occurring after that date.

A similar prohibition has been included in the model WHS Act for Western Australia which is currently awaiting commencement.

Victoria passed legislation in September 2021 to introduce the prohibition to its OHS Act, and the majority of the provisions will commence in September 2022. A core difference with the prohibition in Victoria is that, unlike in NSW, the prohibition appears to apply to penalties for all incidents once it comes it effect, including incidents which occurred before its commencement. This may affect legal proceedings that are currently on foot and which are not resolved before the commencement of the prohibition.

What does the prohibition cover?

The prohibition adopted in NSW is broad and provides that it is an offence for a person to provide or receive the benefit of insurance or indemnification for any penalty imposed under the WHS Act.

A similar approach has been followed in WA and Victoria.

Importantly, the prohibition does not extend to insurance and indemnities for legal costs in defending prosecutions for breaches – the Marie Boland Report stated that companies and officers should not be precluded from accessing insurance or indemnity arrangements for legal costs in defending a prosecution.

What is the rationale for this change?

The rationale for introducing this prohibition, as explained in the Marie Boland Review and Senate Inquiry, is that provision of insurance or indemnification for WHS penalties undermines the deterrent effect of imposing a criminal penalty, and therefore has the potential to reduce compliance with WHS laws. This is of particular concern in the context of officers’ duties, which were introduced into the model WHS Laws as one of the core ‘drivers’ to improve corporate safety.